Using BTW Number to Search for a KVK Number: A Comprehensive Guide

When dealing with businesses in the Netherlands, you might come across two important identifiers: the BTW (Belastingdienst) number and the KVK (Kamer van Koophandel) number. These numbers play a crucial role in identifying and verifying companies. In this article, we will delve into how you can use the BTW number to search for a KVK number, providing you with a detailed and multi-dimensional introduction.

Understanding the BTW Number

The BTW number, also known as the VAT (Value Added Tax) number, is a unique identifier assigned to businesses in the Netherlands for tax purposes. It is essential for companies to have a BTW number when conducting transactions within the country or with other EU member states. This number helps the tax authorities track and monitor the VAT obligations of businesses.

Understanding the KVK Number

The KVK number, on the other hand, is a unique identifier assigned to businesses by the Kamer van Koophandel (Chamber of Commerce). It serves as a registration number for companies in the Netherlands. The KVK number is used to verify the existence and legal status of a business, making it an important tool for businesses and individuals alike.

How to Use the BTW Number to Search for a KVK Number

Now that we have a basic understanding of both numbers, let’s explore how you can use the BTW number to search for a KVK number. Here’s a step-by-step guide:

-

Obtain the BTW number: You can obtain the BTW number from various sources, such as the company’s website, invoices, or official documents.

-

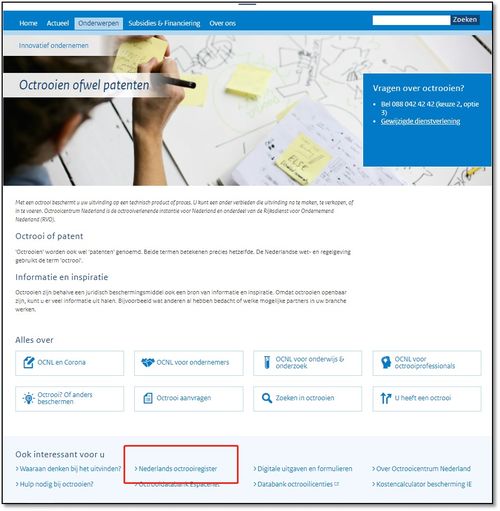

Visit the KVK website: Go to the official KVK website (kvk.nl) and navigate to the “Zoek een bedrijf” (Search a company) section.

-

Enter the BTW number: In the search field, enter the BTW number you obtained in step 1. Make sure to include any leading zeros.

-

Submit the search: Click on the “Zoek” (Search) button to initiate the search.

-

Review the search results: The search results will display the company’s name, KVK number, and other relevant information. Verify that the KVK number matches the one you entered.

Why Use the BTW Number to Search for a KVK Number?

Using the BTW number to search for a KVK number offers several advantages:

-

Efficiency: Searching for a KVK number using the BTW number is a quick and straightforward process.

-

Accuracy: By using the BTW number, you can ensure that you are searching for the correct KVK number associated with the company.

-

Legal compliance: Verifying a company’s KVK number using the BTW number helps ensure that you are dealing with a legitimate and registered business.

Additional Tips

Here are some additional tips to keep in mind when using the BTW number to search for a KVK number:

-

Double-check the BTW number: Ensure that the BTW number you have is accurate and complete, including any leading zeros.

-

Use the correct format: The BTW number should be in the format of 12 digits, including any leading zeros.

-

Consider using a third-party service: If you encounter difficulties searching for a KVK number using the BTW number, consider using a third-party service that specializes in company verification.

Conclusion

Using the BTW number to search for a KVK number is a valuable tool for businesses and individuals in the Netherlands. By following the steps outlined in this article, you can easily verify the existence and legal status of a company. Remember to double-check the BTW number and use the correct format to ensure accurate results.

| Step | Description |

|---|---|