Understanding BTW OP Auto Calculation: A Comprehensive Guide

Calculating BTW (Belastingdienst) OP (Omzetbelasting) Auto is a crucial aspect for businesses in the Netherlands. It involves determining the tax on the value added to goods and services. In this detailed guide, we will explore various dimensions of BTW OP Auto calculation to help you navigate this process effectively.

What is BTW OP Auto Calculation?

BTW OP Auto calculation is the process of determining the tax on the value added to goods and services provided by a business. It is a part of the VAT (Value Added Tax) system in the Netherlands. The calculation involves adding up the value of goods and services sold, subtracting the cost of goods sold, and then applying the applicable VAT rate to the remaining amount.

Understanding the VAT System in the Netherlands

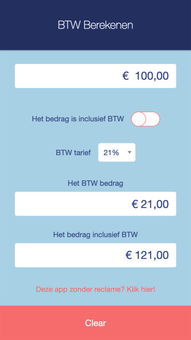

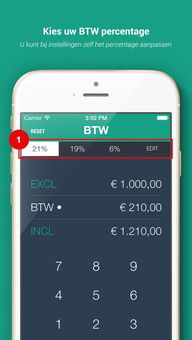

The VAT system in the Netherlands is based on the principle of taxing the value added at each stage of production and distribution. This means that businesses are required to charge VAT on their sales and then claim back the VAT they have paid on their purchases. The VAT rate in the Netherlands is currently set at 21%, with a reduced rate of 9% for certain goods and services.

Calculating BTW OP Auto: The Formula

Calculating BTW OP Auto involves the following formula:

| Formula | Description |

|---|---|

| BTW OP Auto = (Sales – Cost of Goods Sold) VAT Rate | This formula calculates the tax on the value added to goods and services. |

Here, ‘Sales’ refers to the total value of goods and services sold, and ‘Cost of Goods Sold’ refers to the total cost of goods purchased for resale. The ‘VAT Rate’ is the percentage of VAT applicable to the goods and services sold.

Factors Affecting BTW OP Auto Calculation

Several factors can affect the calculation of BTW OP Auto:

-

Applicable VAT Rate: The VAT rate can vary depending on the type of goods and services provided. It is essential to determine the correct VAT rate for each transaction.

-

Cost of Goods Sold: Accurate tracking of the cost of goods sold is crucial for calculating BTW OP Auto. This includes the cost of raw materials, labor, and other expenses directly related to the production of goods.

-

Exemptions and Deductions: Some goods and services may be exempt from VAT or eligible for deductions. It is important to identify these exemptions and deductions to ensure accurate calculations.

-

EU Transactions: If your business engages in cross-border transactions within the European Union, you may need to consider specific VAT rules and rates.

Best Practices for BTW OP Auto Calculation

Here are some best practices to ensure accurate and efficient BTW OP Auto calculation:

-

Keep Detailed Records: Maintain comprehensive records of all transactions, including sales, purchases, and expenses. This will help you track the cost of goods sold and determine the correct VAT rate for each transaction.

-

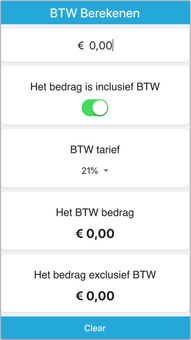

Use Accounting Software: Invest in accounting software that can automate the calculation of BTW OP Auto. This will save time and reduce the risk of errors.

-

Stay Informed: Keep up-to-date with changes in VAT laws and regulations to ensure compliance with the latest requirements.

-

Seek Professional Advice: If you are unsure about any aspect of BTW OP Auto calculation, consult with a tax professional or accountant.

Conclusion

Calculating BTW OP Auto is a critical task for businesses in the Netherlands. By understanding the VAT system, applying the correct formula, and following best practices, you can ensure accurate and efficient calculations. Remember to keep detailed records, use accounting software, stay informed, and seek professional advice when needed.