Understanding Risk Ops: A Comprehensive Guide

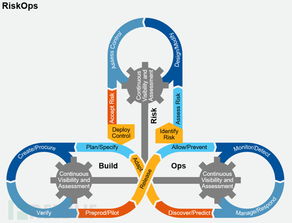

As the digital landscape continues to evolve, the importance of risk management has never been more pronounced. Enter Risk Ops, a multifaceted approach to identifying, assessing, and mitigating risks within an organization. This article delves into the intricacies of Risk Ops, providing you with a detailed understanding of its various dimensions.

What is Risk Ops?

Risk Ops, short for Risk Operations, is a strategic framework that integrates risk management with operational processes. It involves the use of advanced technologies, methodologies, and tools to ensure that risks are identified, analyzed, and managed effectively. By adopting a Risk Ops approach, organizations can proactively address potential threats and vulnerabilities, thereby enhancing their overall resilience.

Key Components of Risk Ops

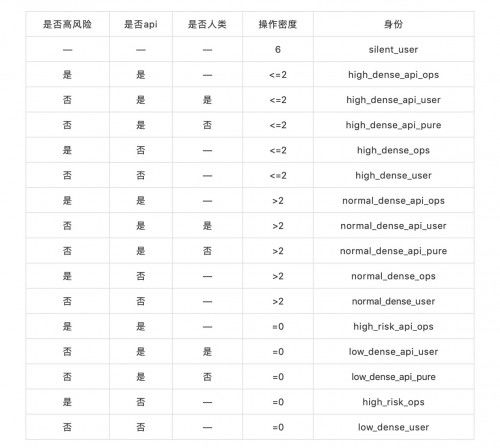

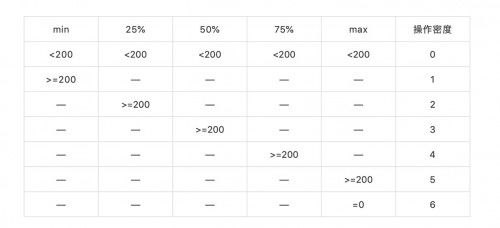

1. Risk Identification: This involves identifying potential risks that could impact the organization’s objectives. These risks can be categorized into various types, such as financial, operational, compliance, and reputational risks.

2. Risk Assessment: Once risks are identified, they need to be assessed to determine their potential impact and likelihood of occurrence. This can be done through qualitative and quantitative methods.

3. Risk Mitigation: After assessing the risks, organizations must develop strategies to mitigate them. This can involve implementing controls, transferring risk through insurance, or accepting certain risks if the potential impact is deemed acceptable.

4. Risk Monitoring: Continuous monitoring of risks is crucial to ensure that mitigation strategies are effective and to identify new risks as they arise.

Benefits of Risk Ops

1. Enhanced Decision-Making: By having a clear understanding of the risks they face, organizations can make more informed decisions, leading to better outcomes.

2. Improved Resilience: Risk Ops helps organizations build resilience by identifying and addressing vulnerabilities, thereby reducing the impact of potential disruptions.

3. Compliance: Risk Ops ensures that organizations adhere to regulatory requirements and industry standards, minimizing the risk of penalties and legal issues.

4. Cost Reduction: By proactively managing risks, organizations can avoid costly incidents and improve their bottom line.

Implementing Risk Ops

1. Establish a Risk Management Framework: Develop a comprehensive risk management framework that aligns with your organization’s objectives and industry standards.

2. Assign Responsibilities: Clearly define roles and responsibilities for risk management within your organization.

3. Invest in Technology: Utilize advanced risk management tools and technologies to streamline the risk management process.

4. Train Employees: Provide training and awareness programs to ensure that employees understand the importance of risk management and their role in it.

5. Monitor and Review: Regularly review and update your risk management strategies to ensure they remain effective.

Case Study: Risk Ops in the Financial Sector

One industry that has successfully implemented Risk Ops is the financial sector. Financial institutions face numerous risks, including credit, market, liquidity, and operational risks. By adopting a Risk Ops approach, these institutions have been able to identify and mitigate these risks effectively. This has resulted in improved financial performance, reduced regulatory penalties, and enhanced customer trust.

Conclusion

Risk Ops is a critical component of any organization’s success. By understanding its various dimensions and implementing it effectively, you can ensure that your organization is well-prepared to face the challenges of the digital age. Remember, the key to successful Risk Ops lies in continuous improvement and adaptation to changing circumstances.