The Co-op Bank Online Banking: A Comprehensive Guide

Managing your finances has never been easier with the Co-op Bank’s online banking service. Whether you’re a seasoned user or new to the platform, this guide will walk you through the ins and outs of Co-op Bank’s online banking, ensuring you get the most out of your financial management experience.

Account Access and Security

Accessing your Co-op Bank account online is straightforward. Simply visit the Co-op Bank website and log in using your username and password. The platform offers robust security measures to protect your personal and financial information. Two-factor authentication is available, adding an extra layer of security to your account.

| Security Features | Description |

|---|---|

| Two-Factor Authentication | Ensures that only you can access your account by requiring a second form of verification, such as a text message or an authentication app. |

| Secure Socket Layer (SSL) | Encrypts your data during transmission, making it nearly impossible for hackers to intercept your information. |

| Firewall Protection | Prevents unauthorized access to your account by blocking suspicious activity. |

Account Management

Once logged in, you’ll have access to a variety of account management tools. Here’s a breakdown of some key features:

-

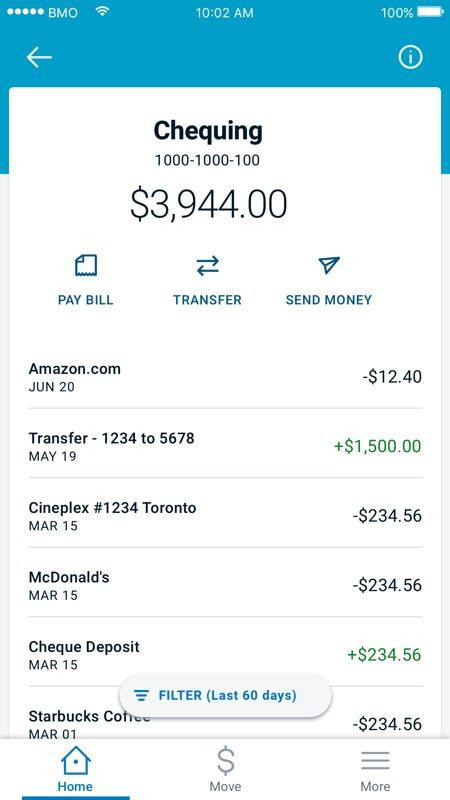

Account Overview: View your account balance, transaction history, and other account details at a glance.

-

Transaction History: Review all transactions made on your account, including deposits, withdrawals, and transfers.

-

Bill Pay: Pay your bills online with ease, scheduling payments in advance to avoid late fees.

-

Transfer Funds: Move money between your Co-op Bank accounts or transfer funds to other financial institutions.

-

Mobile Banking: Access your account on the go with the Co-op Bank mobile app, available for iOS and Android devices.

Personalized Financial Tools

The Co-op Bank online banking platform offers a range of financial tools to help you manage your money more effectively:

-

Spending Tracker: Monitor your spending habits and set budgets to keep your finances on track.

-

Goal Setting: Create financial goals and track your progress towards achieving them.

-

Alerts and Notifications: Receive alerts for low account balances, upcoming bill payments, and other important account activity.

Customer Support

Co-op Bank is committed to providing exceptional customer support. If you encounter any issues or have questions about the online banking platform, you can:

-

Contact the customer support team via phone, email, or live chat.

-

Visit a local branch for in-person assistance.

-

Access the Co-op Bank help center, which offers a wealth of resources and FAQs.

Conclusion

Co-op Bank’s online banking service is a powerful tool for managing your finances. With its user-friendly interface, robust security features, and personalized financial tools, it’s easy to see why so many customers choose Co-op Bank for their financial needs. Take advantage of the platform’s features to take control of your finances and achieve your financial goals.