Understanding the Co-op Credit Union Customer Service Experience

When it comes to financial institutions, customer service is a cornerstone of trust and satisfaction. As a member of a co-op credit union, you have access to a unique blend of personalized service and community-focused values. This article delves into the various dimensions of the Co-op Credit Union customer service experience, ensuring you have a comprehensive understanding of what to expect.

Personalized Attention

One of the standout features of co-op credit unions is their commitment to personalized service. Unlike larger banks, co-op credit unions often have a smaller membership base, which allows them to provide a more intimate and tailored experience. Here’s what you can expect:

-

Knowledgeable staff: Co-op credit unions typically employ staff members who are well-versed in a wide range of financial products and services. This ensures that you receive accurate and helpful advice.

-

Customized solutions: Your financial needs are unique, and co-op credit unions strive to offer solutions that align with your goals and circumstances.

-

Community involvement: Co-op credit unions often have a strong presence in the communities they serve, which means they are invested in your well-being and success.

Convenience

While personalized service is a priority, co-op credit unions also understand the importance of convenience. Here’s how they make it easy for you to manage your finances:

-

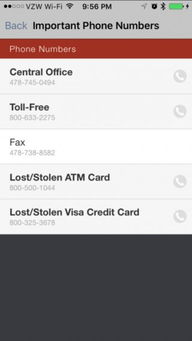

Multiple branch locations: Co-op credit unions typically have a network of branches that are strategically located to serve their members.

-

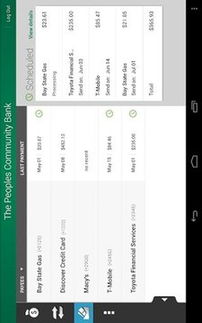

Online and mobile banking: With online and mobile banking options, you can access your accounts, make transactions, and manage your finances from anywhere at any time.

-

ATM access: Co-op credit unions often have partnerships with other financial institutions, providing you with access to a wide network of ATMs.

Competitive Rates and Products

Co-op credit unions are known for offering competitive rates on loans, savings accounts, and other financial products. Here’s what you can expect:

-

Low-interest rates: Co-op credit unions often offer lower interest rates on loans, helping you save money over time.

-

Competitive savings rates: With higher interest rates on savings accounts, you can grow your money more effectively.

-

Wide range of products: From personal loans to mortgages, co-op credit unions offer a diverse array of financial products to meet your needs.

Community Involvement

Co-op credit unions are deeply rooted in their communities, and they take pride in supporting local initiatives and organizations. Here’s how they contribute:

-

Donations and sponsorships: Co-op credit unions often donate to local charities and sponsor community events.

-

Volunteer opportunities: Members are encouraged to volunteer their time and skills to support community projects.

-

Education programs: Co-op credit unions offer financial literacy workshops and resources to help members make informed financial decisions.

Transparency and Trust

Transparency is a cornerstone of the co-op credit union customer service experience. Here’s how they maintain trust with their members:

-

Clear communication: Co-op credit unions strive to provide clear and concise information about their products, services, and policies.

-

Member-owners: As a member, you have a say in the direction of the credit union through your vote at annual meetings.

-

Financial stability: Co-op credit unions are regulated and insured, ensuring the safety of your deposits.

Conclusion

As a member of a co-op credit union, you can expect a personalized, convenient, and community-focused customer service experience. With competitive rates, a wide range of financial products, and a commitment to transparency and trust, co-op credit unions are an excellent choice for your financial needs. Take the time to explore the benefits of joining a co-op credit union and discover the difference they can make in your financial journey.

| Service | Description |

|---|---|

| Personal

|