Accounting Co-op Positions: A Comprehensive Guide

Embarking on a career in accounting can be an exciting journey, and one way to gain valuable experience is through a co-op position. These opportunities allow students to apply their academic knowledge in real-world settings, providing them with a competitive edge in the job market. In this article, we will delve into the various aspects of accounting co-op positions, including their benefits, types, and how to secure one.

Understanding Accounting Co-op Positions

Accounting co-op positions are work-integrated learning opportunities that combine academic study with practical experience. These positions are typically offered by companies, organizations, or educational institutions and are designed to provide students with hands-on experience in the field of accounting.

During a co-op position, students work alongside professionals in the accounting industry, gaining insights into various accounting practices, such as financial reporting, auditing, tax preparation, and management accounting. This experience not only enhances their technical skills but also helps them develop soft skills like teamwork, communication, and problem-solving.

Benefits of Accounting Co-op Positions

Engaging in an accounting co-op position offers numerous benefits, both for students and employers. Here are some of the key advantages:

-

Gain practical experience: Co-op positions provide students with the opportunity to apply their academic knowledge in real-world scenarios, allowing them to develop a deeper understanding of the accounting field.

-

Build a professional network: Working alongside professionals in the industry can help students establish valuable connections, which may lead to future job opportunities.

-

Enhance employability: Employers often prefer candidates with co-op experience, as it demonstrates a commitment to the field and a willingness to learn.

-

Develop soft skills: Co-op positions require students to work in teams, communicate effectively, and solve problems, helping them develop essential soft skills for their future careers.

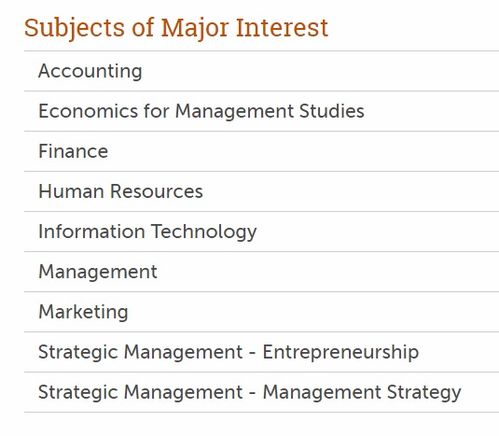

Types of Accounting Co-op Positions

Accounting co-op positions can vary widely in terms of industry, company size, and specific responsibilities. Here are some common types of accounting co-op positions:

-

Public accounting: Students work in firms that provide auditing, tax, and consulting services to clients.

-

Corporate accounting: Students work in companies, handling financial reporting, budgeting, and internal controls.

-

Government accounting: Students work in government agencies, managing public funds and ensuring compliance with regulations.

-

Non-profit accounting: Students work in non-profit organizations, managing financial resources and ensuring compliance with tax laws.

How to Secure an Accounting Co-op Position

Securing an accounting co-op position requires careful planning and preparation. Here are some steps to help you get started:

-

Research potential employers: Identify companies, organizations, or educational institutions that offer accounting co-op positions and research their co-op programs.

-

-

-

Table: Accounting Co-op Positions and Their Responsibilities

| Position | Responsibilities |

|---|---|

| Public Accounting | Perform audits, prepare tax returns, and provide consulting services to clients. |

| Corporate Accounting | Prepare financial statements, manage budgets, and ensure compliance with financial regulations. |

| Government Accounting | Manage public funds, ensure compliance with regulations, and provide financial advice to government agencies. |

| Non-Profit Accounting | Manage financial

|