Understanding the Co-op Bank Account Hacking Incident

Have you ever wondered what happens when your co-op bank account gets hacked? It’s a situation that can leave you feeling violated and financially vulnerable. In this article, we’ll delve into the details of a recent co-op bank account hacking incident, exploring the aftermath, the methods used by the hackers, and the steps you can take to protect yourself.

Incident Overview

The Co-op Bank, a well-known financial institution, recently fell victim to a sophisticated hacking attack. The hackers managed to gain unauthorized access to a number of customer accounts, leading to unauthorized transactions and financial loss. The bank quickly responded by notifying affected customers and working to mitigate the damage.

How the Hackers Got In

Security experts believe that the hackers exploited a vulnerability in the bank’s online banking system. They likely used phishing techniques to trick customers into providing their login credentials, which they then used to gain access to the accounts. Once inside, the hackers were able to make unauthorized transactions and transfer funds to their own accounts.

| Method Used | Description |

|---|---|

| Phishing | Tricking customers into providing their login credentials by sending fraudulent emails or messages. |

| Malware | Installing malicious software on the bank’s systems to steal sensitive information. |

| SQL Injection | Inserting malicious code into a database query to gain unauthorized access to data. |

Impact on Customers

The hacking incident had a significant impact on the affected customers. Many reported unauthorized transactions, including transfers to foreign accounts and purchases made using their credit cards. The financial loss varied from a few hundred dollars to several thousand, depending on the severity of the attack.

Bank’s Response

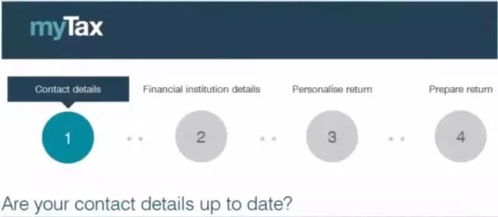

The Co-op Bank took immediate action to address the incident. They notified affected customers via email and phone, offering assistance and guidance on how to protect their accounts. The bank also worked with law enforcement agencies to investigate the attack and identify the hackers. In addition, the bank has implemented several security measures to prevent future incidents, including strengthening their online banking system and enhancing customer authentication processes.

Steps to Protect Yourself

As a customer, it’s important to take steps to protect yourself from similar attacks. Here are some tips to consider:

- Be cautious of phishing emails and messages: Never click on suspicious links or provide your login credentials in response to unsolicited requests.

- Use strong passwords: Create unique passwords for each of your accounts and consider using a password manager to keep track of them.

- Enable two-factor authentication: This adds an extra layer of security by requiring a second form of verification, such as a text message or authentication app.

- Monitor your accounts regularly: Keep an eye on your bank statements and report any unauthorized transactions immediately.

- Keep your software up to date: Regularly update your operating system, web browser, and antivirus software to protect against vulnerabilities.

Conclusion

The Co-op Bank account hacking incident serves as a reminder of the importance of cybersecurity in today’s digital world. By understanding the methods used by hackers and taking proactive steps to protect yourself, you can minimize the risk of falling victim to similar attacks. Stay vigilant and informed, and remember that your financial security is in your hands.