Understanding the Co-op Student Tax Credit (CRA)

Are you a student looking to gain valuable work experience through a co-op program? If so, you might be eligible for the Co-op Student Tax Credit (CRA). This credit is designed to help offset the costs associated with participating in a co-op program, making it more accessible for students. In this article, we will delve into the details of the Co-op Student Tax Credit, its eligibility criteria, how to claim it, and its benefits.

What is the Co-op Student Tax Credit (CRA)?

The Co-op Student Tax Credit is a non-refundable tax credit offered by the Canada Revenue Agency (CRA) to students who are enrolled in a co-op program at a designated educational institution. This credit is intended to help students cover the costs of tuition, books, and other expenses incurred while participating in a co-op program.

Eligibility Criteria

Not all students are eligible for the Co-op Student Tax Credit. To qualify, you must meet the following criteria:

-

Be a full-time student enrolled in a co-op program at a designated educational institution.

-

Have a valid Social Insurance Number (SIN).

-

Have incurred eligible expenses while participating in the co-op program.

-

Not be claimed as a dependent on someone else’s tax return.

Eligible expenses include tuition fees, books, and other costs directly related to your co-op program. It’s important to keep receipts and documentation of these expenses to support your claim.

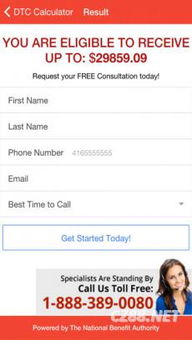

How to Claim the Co-op Student Tax Credit

Claiming the Co-op Student Tax Credit is a straightforward process. Here’s what you need to do:

-

Complete the T2202A form provided by your educational institution. This form confirms your enrollment in a co-op program and the amount of eligible expenses you incurred.

-

Fill out the T4E form, which is used to claim the Co-op Student Tax Credit. You can find this form in the CRA’s tax package or online.

-

Attach the T2202A form and any supporting documentation to your tax return.

-

Submit your tax return to the CRA.

Remember to keep copies of all documents for your records.

Benefits of the Co-op Student Tax Credit

The Co-op Student Tax Credit offers several benefits to students:

-

Financial Relief: The credit can help offset the costs of tuition, books, and other expenses associated with your co-op program.

-

Increased Accessibility: By reducing the financial burden of participating in a co-op program, the credit makes it more accessible to a wider range of students.

-

Work Experience: Co-op programs provide valuable work experience that can enhance your resume and make you more competitive in the job market.

Table: Co-op Student Tax Credit Amounts

| Year | Amount |

|---|---|

| 2021 | $1,000 |

| 2022 | $1,000 |

| 2023 | $1,000 |

As you can see from the table, the Co-op Student Tax Credit amount remains at $1,000 for the years 2021, 2022, and 2023.

Conclusion

The Co-op Student Tax Credit is a valuable resource for students looking to gain work experience through a co-op program. By understanding the eligibility criteria, claiming process, and benefits of this credit, you can make the most of this opportunity. Don’t hesitate to contact the CRA or your educational institution for more information if you have any questions.