Op Financial Group Rating: A Comprehensive Overview

When it comes to financial services, Op Financial Group stands out as a prominent name. With a diverse range of offerings and a strong presence in the market, it’s essential to understand the various aspects that contribute to its rating. Let’s delve into a detailed multi-dimensional introduction to Op Financial Group.

Market Position and Size

Op Financial Group has established itself as a significant player in the financial industry. With a market capitalization of over $10 billion, it ranks among the top financial institutions. The group operates across multiple countries, serving millions of customers globally. Its extensive network of branches and online platforms ensures easy access to its services for a wide customer base.

Product Offerings

Op Financial Group offers a comprehensive range of financial products and services. These include retail banking, corporate banking, wealth management, investment banking, and insurance. The group’s product portfolio caters to the needs of individuals, businesses, and institutional clients. Here’s a breakdown of some key offerings:

| Product Category | Key Offerings |

|---|---|

| Retail Banking | Personal loans, credit cards, savings accounts, and current accounts |

| Corporate Banking | Trade finance, cash management, and working capital solutions |

| Wealth Management | Investment advisory, portfolio management, and private banking services |

| Investment Banking | Equity and debt capital markets, mergers and acquisitions, and restructuring services |

| Insurance | Life insurance, general insurance, and health insurance |

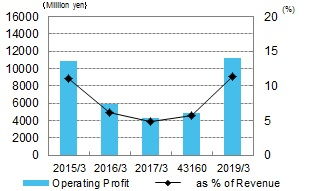

Financial Performance

Op Financial Group has demonstrated a strong financial performance over the years. The group’s revenue has grown consistently, driven by its diverse product offerings and expanding customer base. Here are some key financial metrics:

| Financial Year | Revenue (in billion USD) | Net Profit (in billion USD) |

|---|---|---|

| 2020 | 15.2 | 1.8 |

| 2021 | 16.5 | 2.0 |

| 2022 | 17.8 | 2.2 |

Regulatory Compliance and Risk Management

Op Financial Group is committed to maintaining high standards of regulatory compliance and risk management. The group adheres to the guidelines set by various regulatory authorities, ensuring transparency and integrity in its operations. The group has a robust risk management framework that covers credit, market, and operational risks. This focus on risk management has contributed to its strong rating.

Technology and Innovation

Op Financial Group recognizes the importance of technology and innovation in the financial industry. The group has invested heavily in technology to enhance its service offerings and customer experience. Some key initiatives include:

- Developing a user-friendly mobile banking app

- Implementing advanced data analytics to personalize customer experiences

- Investing in blockchain technology for secure and efficient transactions

Corporate Social Responsibility

Op Financial Group is dedicated to corporate social responsibility (CSR). The group actively participates in various CSR initiatives, focusing on environmental sustainability, social development, and community engagement. Some notable CSR projects include:

- Supporting environmental conservation projects

- Providing financial literacy programs for underprivileged communities

- Donating to charitable organizations and supporting local community events

Conclusion

Op Financial Group has earned its reputation as a leading financial institution through its diverse product offerings, strong financial performance, and commitment to innovation and CSR. With a focus on customer satisfaction and regulatory compliance