Understanding OP Dividend: A Comprehensive Guide

Investing in the stock market can be a daunting task, especially when it comes to understanding the intricacies of dividends. One term that often comes up is “OP Dividend.” But what exactly is an OP Dividend, and how does it differ from other types of dividends? Let’s delve into this topic and explore the various aspects of OP Dividends.

What is an OP Dividend?

An OP Dividend, short for “Outstanding Dividend,” refers to a dividend that has been declared by a company but has not yet been paid to shareholders. This type of dividend is often associated with companies that have a history of paying dividends and are expected to distribute them in the near future.

How Does an OP Dividend Work?

When a company decides to pay a dividend, it goes through a series of steps. Here’s a brief overview of how an OP Dividend works:

-

The company’s board of directors declares a dividend, specifying the amount and the date of record.

-

Shareholders who own the stock on the record date are eligible to receive the dividend.

-

The company sets a payment date, which is the date when the dividend is actually distributed to shareholders.

-

Between the declaration date and the payment date, the dividend is considered an OP Dividend.

Why is an OP Dividend Important?

Understanding OP Dividends is crucial for investors for several reasons:

-

Investment Decisions: Knowing whether a company has an OP Dividend can help investors make informed decisions about their investments. For example, if a company has an OP Dividend, it may indicate that the company is financially stable and has a strong track record of paying dividends.

-

Dividend Yield: OP Dividends can affect the dividend yield of a stock. Dividend yield is calculated by dividing the annual dividend by the stock’s price. If a company has an OP Dividend, the dividend yield may be higher than it appears on paper.

-

Market Perception: An OP Dividend can also influence the market perception of a company. A company with an OP Dividend may be seen as more attractive to investors, which could lead to increased demand for its stock.

Comparing OP Dividends to Other Dividends

There are several types of dividends, and it’s important to understand how OP Dividends compare to others:

-

Regular Dividends: These are dividends that are paid out on a regular basis, such as quarterly or annually. Regular dividends are the most common type of dividend and are typically paid to shareholders who own the stock on the record date.

-

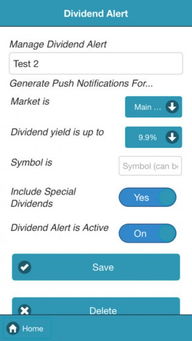

Special Dividends: These are one-time dividends that are paid out in addition to regular dividends. Special dividends are often paid when a company has excess cash on hand or when it wants to reward shareholders for their loyalty.

-

Stock Dividends: Instead of receiving cash, shareholders receive additional shares of stock as a dividend. Stock dividends can increase the number of shares an investor owns, potentially lowering the stock’s price per share.

How to Find OP Dividends

Investors can find information about OP Dividends in several ways:

-

Financial Statements: Companies include information about dividends in their financial statements, such as the annual report and quarterly reports.

-

Dividend History: Many financial websites and stock market platforms provide dividend history for publicly traded companies.

-

Dividend Calendar: Some websites offer dividend calendars that list upcoming dividend payments, including OP Dividends.

Conclusion

OP Dividends are an important aspect of investing in the stock market. By understanding what they are, how they work, and how they compare to other types of dividends, investors can make more informed decisions about their investments. Whether you’re a seasoned investor or just starting out, knowing about OP Dividends can help you better navigate the world of dividends and potentially increase your returns.